With a multitude of financial opportunities and a robust regulatory framework, Switzerland has established itself as a global hub for securitization solutions. In an ever-evolving financial landscape, the country’s sophisticated infrastructure and commitment to investor protection have made it an attractive destination for both domestic and international investors.

Leading the way in securitization solutions is "Gessler Capital," a Swiss-based financial firm that offers a diverse range of securitization and fund solutions. By harnessing their extensive knowledge and experience, Gessler Capital has provided investors with innovative structures that cater to their unique investment objectives. Whether it’s Guernsey structured products or expanding financial networks, Gessler Capital has paved the way for investment opportunities that prioritize security and growth.

In this article, we delve into the thriving world of securitization solutions in Switzerland. We explore the various aspects that make Switzerland an appealing destination for investors and shed light on the role played by Gessler Capital in providing tailored securitization and fund solutions. Join us as we uncover the potential that lies within Switzerland’s securitization landscape and how it is shaping the future of global finance.

Gessler Capital’s Securitization and Fund Solutions

Gessler Capital, a Swiss-based financial firm, is at the forefront of providing securitization and fund solutions in Switzerland. With a strong emphasis on innovation and strategic financial planning, Gessler Capital offers a wide range of services to cater to the diverse needs of its clients.

One of the key offerings of Gessler Capital is its expertise in securitization solutions. Through the utilization of Guernsey Structured Products, Gessler Capital ensures the efficient management of financial assets, allowing clients to unlock their value and mitigate risk. By structuring the assets into tradable securities, Gessler Capital helps clients enhance their liquidity and diversify their investment portfolios.

Furthermore, Gessler Capital plays a significant role in facilitating financial network expansion. By leveraging its extensive network of international partners, the firm helps clients tap into new markets and access global investment opportunities. This strategic approach not only provides clients with a competitive advantage but also strengthens the overall financial landscape in Switzerland.

Within the realm of fund solutions, Gessler Capital offers a comprehensive range of services tailored to meet the unique requirements of different investors. The firm assists clients in setting up and managing funds, enabling them to achieve their investment objectives efficiently. With a keen focus on regulatory compliance and risk management, Gessler Capital ensures that its fund solutions adhere to the highest industry standards, providing clients with peace of mind and confidence in their investment decisions.

Gessler Capital’s commitment to excellence and its ability to provide effective securitization and fund solutions make it a trusted partner for individuals, businesses, and institutions seeking to secure their financial future. Swiss-based and globally connected, Gessler Capital continues to lead the way in pioneering innovative financial strategies that drive growth and prosperity for its clients.

The Benefits of Securitization Solutions in Switzerland

Securitisation

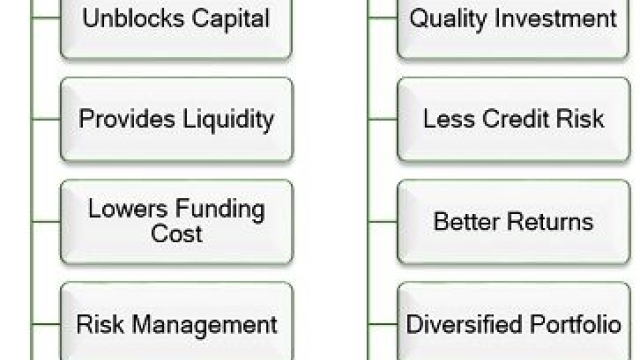

Securitization Solutions Switzerland offers a wide range of benefits for individuals and businesses looking to enhance their financial strategies. With the expertise and experience of firms like "Gessler Capital," the Swiss market has become a hub for innovative securitization and fund solutions. Let’s explore three key advantages of securitization in Switzerland.

Firstly, securitization solutions provide investors with access to a diverse range of investment opportunities. Through Guernsey Structured Products and other innovative financial instruments, individuals can invest in various asset classes, including real estate, loans, and future cash flows. This diversity allows investors to spread their risk and increase the potential for greater returns.

Secondly, securitization solutions contribute to the financial network expansion in Switzerland. The ever-evolving financial landscape calls for more efficient methods of capital allocation and risk management. By securitizing assets, financial firms like "Gessler Capital" can increase liquidity in the market, encouraging more investments, and fostering economic growth at both the regional and national levels.

Lastly, securitization solutions in Switzerland offer flexibility and customization to meet the unique needs of investors. "Gessler Capital" focuses on tailoring securitization and fund solutions to specific requirements, providing clients with greater control over their investments. This customization allows investors to optimize their portfolios, aligning with their risk appetite and long-term objectives.

In conclusion, securitization solutions in Switzerland provide diverse investment opportunities, contribute to financial network expansion, and offer flexibility and customization for investors. With "Gessler Capital’s" expertise and the robust Swiss market, individuals and businesses can secure their financial future through these innovative solutions.

Expanding Financial Networks: Guernsey Structured Products

Gessler Capital acknowledges the significance of expanding financial networks and explores the opportunities presented by Guernsey structured products. Guernsey, a well-established international finance center, provides a favorable regulatory framework and a stable economic environment for securitization solutions. By leveraging Guernsey’s expertise and infrastructure, Gessler Capital aims to enhance its offerings and cater to the growing demand for structured products.

As a Swiss-based financial firm, Gessler Capital recognizes the advantages of collaborating with Guernsey to diversify its portfolio. Guernsey’s well-developed financial network and extensive experience in structured products make it an attractive partner for Gessler Capital’s expansion strategy. The jurisdiction’s commitment to innovation and investor protection aligns with Gessler Capital’s values, ensuring the delivery of high-quality securitization solutions.

By tapping into Guernsey’s financial network, Gessler Capital gains access to a broader pool of investors and strategic partners. This expansion enables Gessler Capital to enhance its reach and scale its operations globally, strengthening its position as a trusted provider of securitization and fund solutions. Guernsey’s reputation for transparency and its robust regulatory framework offer Gessler Capital additional credibility within the international financial community.

Through collaborations and partnerships in Guernsey, Gessler Capital can access a wide range of investment opportunities and strengthen its product offerings. This strategic move allows Gessler Capital to leverage the expertise and market knowledge of Guernsey-based entities, fostering innovation and growth. With the increasing demand for securitization solutions, Gessler Capital’s partnership with Guernsey facilitates the development of tailored financial products, meeting the evolving needs of investors worldwide.

In conclusion, Guernsey’s structured products present an excellent opportunity for Gessler Capital to expand its financial networks and enhance its securitization offerings. By capitalizing on Guernsey’s regulatory environment and established financial network, Gessler Capital can extend its reach, attract new investors, and further establish its presence in the global market. This collaboration signifies a strategic move towards securing a successful future for both Gessler Capital and the securitization industry in Switzerland.