When it comes to protecting assets, many businesses are turning to a powerful financial tool known as captive insurance. Captive insurance, often referred to as 831b insurance due to its association with section 831(b) of the IRS tax code, offers a unique opportunity for companies to take control of their risk management while also reaping significant financial advantages. By creating their own insurance company or participating in a microcaptive, businesses can unlock a world of potential benefits that traditional insurance options simply cannot match. In this article, we will explore the advantages of captive insurance and how it can revolutionize the way companies protect their interests in an ever-changing business landscape. So, let’s delve into the captivating world of captive insurance and discover why it is rapidly gaining popularity among savvy business owners.

Understanding Captive Insurance

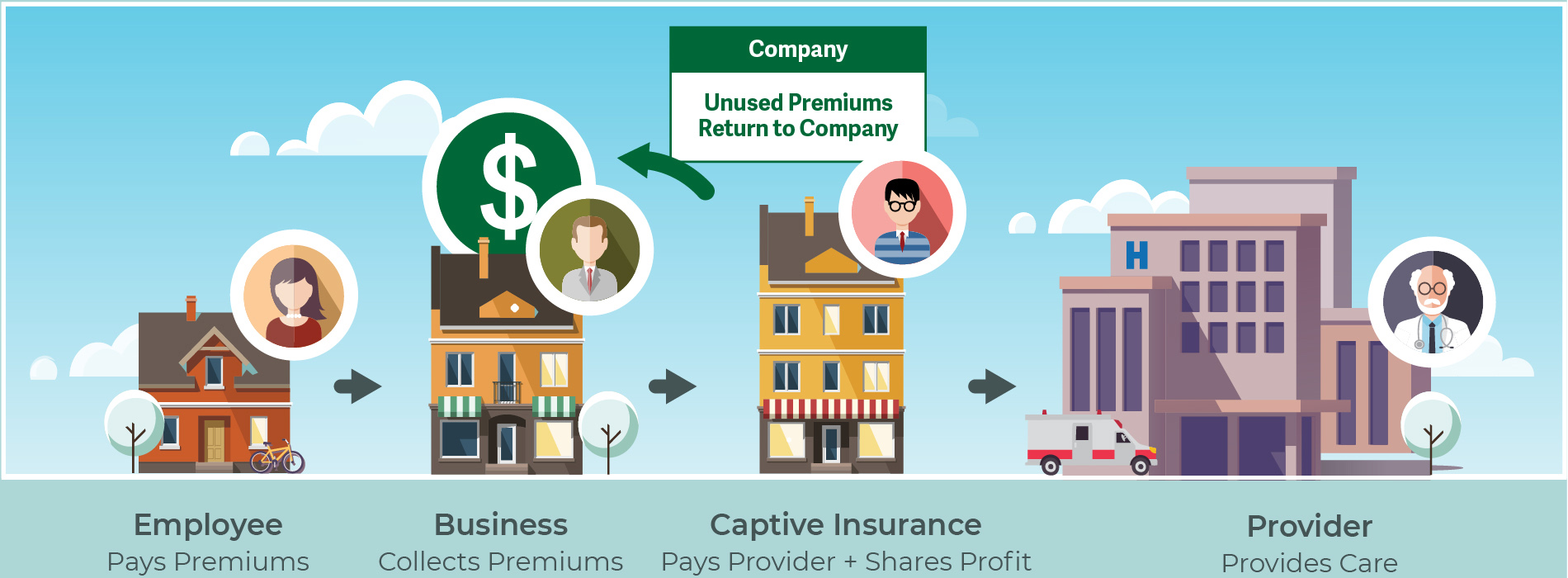

Captive insurance, also known as microcaptive insurance or 831(b) insurance, is a type of self-insurance that provides unique benefits for businesses. Instead of relying solely on traditional insurance carriers, companies can establish their own captive insurance company to underwrite their risks. This offers a more tailored approach to managing risks and can lead to significant cost savings.

By forming a captive insurance company, businesses have greater control over their insurance coverage and claims process. They can customize policies to better suit their specific needs and risk profile. This flexibility allows companies to insure risks that may be difficult or expensive to cover through traditional insurance providers.

One of the key advantages of captive insurance is the potential for tax benefits. Under the IRS 831(b) tax code, qualifying small captive insurance companies can elect to be taxed only on their investment income, rather than on their underwriting profits. This can result in reduced tax liabilities for businesses.

Overall, captive insurance provides businesses with a valuable alternative to traditional insurance arrangements. It allows companies to take a more strategic approach to risk management and potentially save on insurance costs. Understanding the intricacies of captive insurance can empower businesses to unlock its full potential and achieve greater stability and financial security.

Benefits of 831(b) Captive Insurance

Enhanced Risk Management: Captive insurance, specifically the 831(b) structure, offers businesses a valuable tool to manage and mitigate their risk exposures. By setting up their own captive insurance company, businesses can tailor coverage to their unique needs, providing greater control over their risk management strategies. With a captive insurance program in place, businesses can protect their assets, manage claims more efficiently, and gain valuable insights into their risk profiles.

Cost Savings: One of the key advantages of 831(b) captive insurance is the potential for cost savings. By retaining part of the risk and insuring through their captive, businesses can potentially reduce their overall insurance expenses. This cost-saving benefit arises as the captive insurance company is not motivated by profit margins like traditional insurance carriers, making it possible for businesses to obtain insurance coverage at more favorable rates.

Tax Benefits: The use of an 831(b) captive insurance company provides businesses with unique tax advantages as per the IRS 831(b) tax code. Under this provision, premiums received by the captive insurance company are taxed at a reduced rate, enabling businesses to decrease their tax liabilities. This tax-efficient structure allows businesses to accumulate reserves within the captive, providing additional financial benefits in the long term.

In conclusion, the utilization of captive insurance, particularly within the 831(b) framework, presents several key benefits for businesses. It strengthens their risk management capabilities, offers potential cost savings, and provides tax advantages. By understanding and harnessing the advantages of captive insurance, businesses can unlock their potential for enhanced risk protection and financial stability.

Navigating the IRS 831(b) Tax Code

Captive insurance companies operating under the IRS 831(b) tax code can offer significant advantages to businesses. This tax code specifically caters to microcaptives, which are captives with annual premiums not exceeding $2.3 million. Understanding the intricacies of the IRS 831(b) tax code is crucial for effectively leveraging the benefits of captive insurance.

Captive Insurance

One key advantage of the IRS 831(b) tax code is the favorable tax treatment it provides. Captive insurance companies operating under this code can elect to be taxed only on their investment income, rather than on premium income received from insured parties. This can result in a considerable reduction in tax liabilities for businesses that qualify.

Additionally, by establishing a captive insurance company within the limits of the IRS 831(b) tax code, businesses can gain greater control over their risk management strategies. Captives can customize insurance coverage to suit their specific needs, ensuring comprehensive protection against potential losses. This flexibility allows businesses to tailor their insurance programs to address industry-specific risks and provide more adequate coverage.

Furthermore, the IRS 831(b) tax code allows businesses to accumulate wealth through the captive insurance structure. By retaining underwriting profits within the captive, businesses can build up reserves and access those funds in the event of future claims or losses. This accumulation of wealth can serve as a long-term financial strategy, providing businesses with increased liquidity and stability.

Navigating the complexities of the IRS 831(b) tax code is crucial for businesses looking to unlock the potential advantages of captive insurance. By understanding the intricacies of this code, businesses can optimize their risk management strategies, achieve tax savings, maintain control over insurance coverages, and accumulate wealth through their captive insurance structure.